ESB has a strong balance sheet and liquidity position, and maintaining the financial performance and strength required to deliver our ‘Driven to Make a Difference: Net Zero by 2040’ strategy is a key foundational capability. We are committed to maintaining a strong investment grade credit rating and secure optimal long-term funding to match investment plans for a net zero future.

As part of our broader Green Financing Strategy, we are using sustainable finance options such as Green Bonds to fund the delivery of our strategy. We believe these bonds offer transparency to investors who wish to allocate funds to green assets, and in doing so allowing them to support our transition to reliable, affordable, low-carbon energy.

Group debt as at 31 December 2024

| Type | Percentage |

| Euro Bonds | 48% |

| Green Bonds | 23% |

| GBP Bonds | 23% |

| Bilateral (mainly EIB) | 6% |

Available liquidity as at 31 December 2024

| Type | Percentage |

| Committed facilities | 65% |

| Cash | 35% |

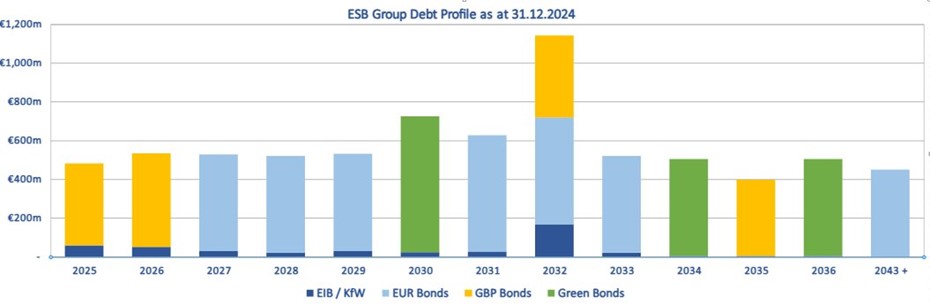

ESB Debt Maturity

Group Debt Profile as at 31 December 2024

ESB Financing Programmes and Facilities

The majority of ESB’s financing needs are met from the stable cash flows generated by our operating activities. Additional financing requirements are funded through a combination of capital market issues and bank borrowings. The combination of these

facilities provides the prudence, diversity and flexibility which underline our financial strategy.

ESB Group Debt

As at 31 December 2024 ESB's debt totalled €7.5 billion.

Bond Information

As at 30 June 2024

| Issuer | Currency | Maturity | Amount Outstanding | Coupon | ISIN | Euronext Dublin (GEM) | Final Terms/Pricing Supplement |

| ESB Finance DAC | EUR | 2043 | 350,000,000 | 3.75% | XS2579482006 | Irish Stock Exchange | Download Report |

| NIE Finance PLC | GBP | 2032 | 350,000,000 | 5.875% | XS2528656080 | London Stock Exchange | Download Report |

| ESB Finance DAC | EUR | 2032 | 550,000,000 | 4% | XS2550909415 | Irish Stock Exchange | Download Report |

| ESB Finance DAC | EUR | 2034 | 500,000,000 | 1% | XS2432544349 | Irish Stock Exchange | Download Report |

| ESB Finance DAC | EUR | 2030 | 700,000,000 | 1.125% | XS2009861480 | Irish Stock Exchange | Download Report |

| ESB Finance DAC | EUR | 2044 | 100,000,000 | 2% | XS1981749044 | Irish Stock Exchange | Download Report |

| ESB Finance DAC | EUR | 2033 | 500,000,000 | 2.125% | XS1903442744 | Irish Stock Exchange | Download Report |

| ESB Finance DAC | EUR | 2029 | 500,000,000 | 1.750% | XS1560853670 | Irish Stock Exchange | Download Report |

| ESB Finance DAC | EUR | 2031 | 600,000,000 | 1.875% | XS1428782160 | Irish Stock Exchange | Download Report |

| ESB Finance DAC | GBP | 2035 | 325,000,000 | 1.875% | XS2105811116 | Irish Stock Exchange | Download Report |

| NIE Finance PLC | GBP | 2026 | 400,000,000 | 6.375% | XS0633547087 | London Stock Exchange | Download Report |

| NIE Finance PLC | GBP | 2025 | 350,000,000 | 2.500% | XS1820002308 | London Stock Exchange

| Download Report |

| ESB Finance DAC | EUR | 2027 | 500,000,000 | 2.125% | XS1239586594 | Irish Stock Exchange | Download Report |

| ESB Finance DAC | EUR | 2028 | 500,000,000 | 4% | XS2697983869 | Irish Stock Exchange | Download Report |

| ESB Finance DAC | EUR | 2036 | 500,000,000 | 4.25% | XS2697970536 | Irish Stock Exchange | Download Report |

ESB Capital Markets Funding

Euro Medium Term Note Programme (EMTN) – ESB Finance DAC

In the capital markets we have a €8 billion Euro Medium Term Note Programme (EMTN) under which a number of Euro bonds and one GBP bond have been issued since March 2010. In addition to the EMTN issues, ESB’s subsidiary Northern Ireland Electricity has issued three GBP bonds.